The leading investment and asset manager

READ MORE

The most active and innovative investor in private equity and real estate in CEE

The leading investment and asset manager

READ MORE

The most active and innovative investor in private equity and real estate in CEE

The leading investment and asset manager

READ MORE

The most active and innovative investor in private equity and real estate in CEE

The leading investment and asset manager

READ MORE

The most active and innovative investor in private equity and real estate in CEE

OVER 25 YEARS’

TRACK RECORD

TRACK RECORD

EUR

0

+ BN

gross asset value across

16 platforms

16 platforms

EUR

0

+ BN

total value of

Partners' transactions

Partners' transactions

EUR

0

+ BN

total invested

equity

equity

0

+

successfully

executed transactions

executed transactions

0

+

employees across 16

investment platforms

investment platforms

Investment

platforms

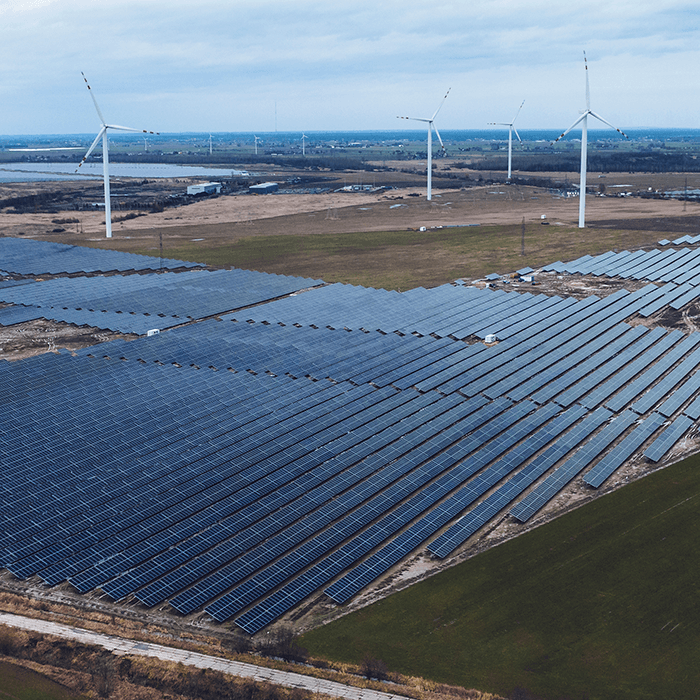

We unlock business potential

We start platform companies from scratch or acquire and develop them to best in class market leaders

We identify their strengths and develop individual strategies for growth and strong management teams

We build their value through organic growth and progressive add-on acquisitions, creating market leaders

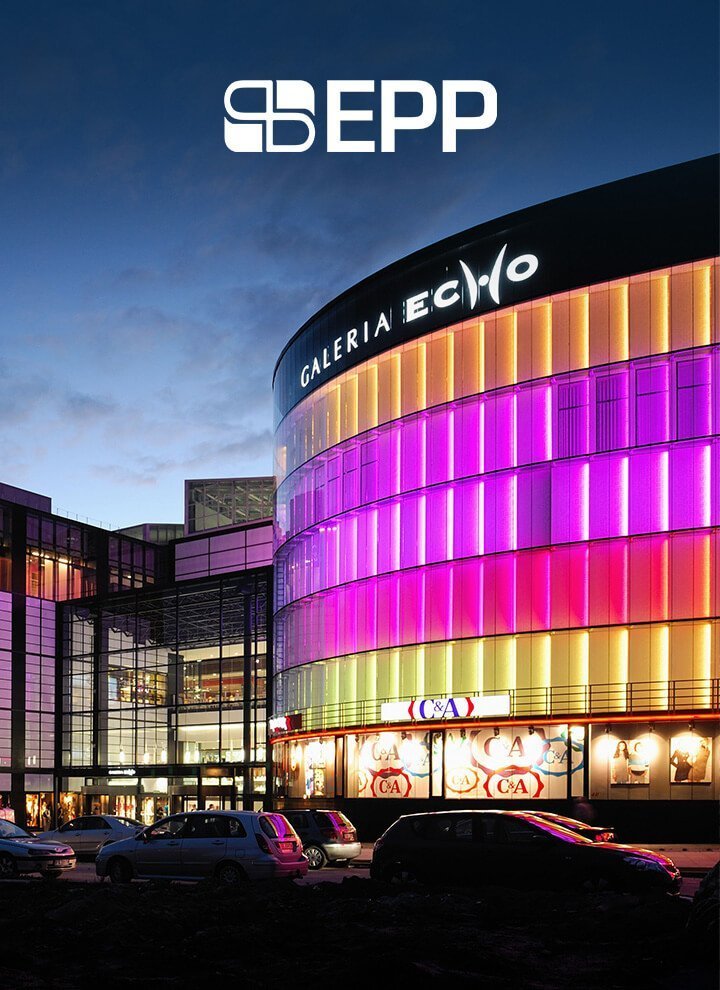

The biggest Polish developer in the office, commercial and residential real estate sector

A new platform aiming to develop, as a first step, a portfolio of 5,000 student beds

A leading Poland-focused logistics platform owned by Redefine, Madison and Griffin

A fast-growing logistics platform focused on investing in industrial and logistics space in key European markets

Maciej Dyjas & Nebil Șenman

Managing Partners